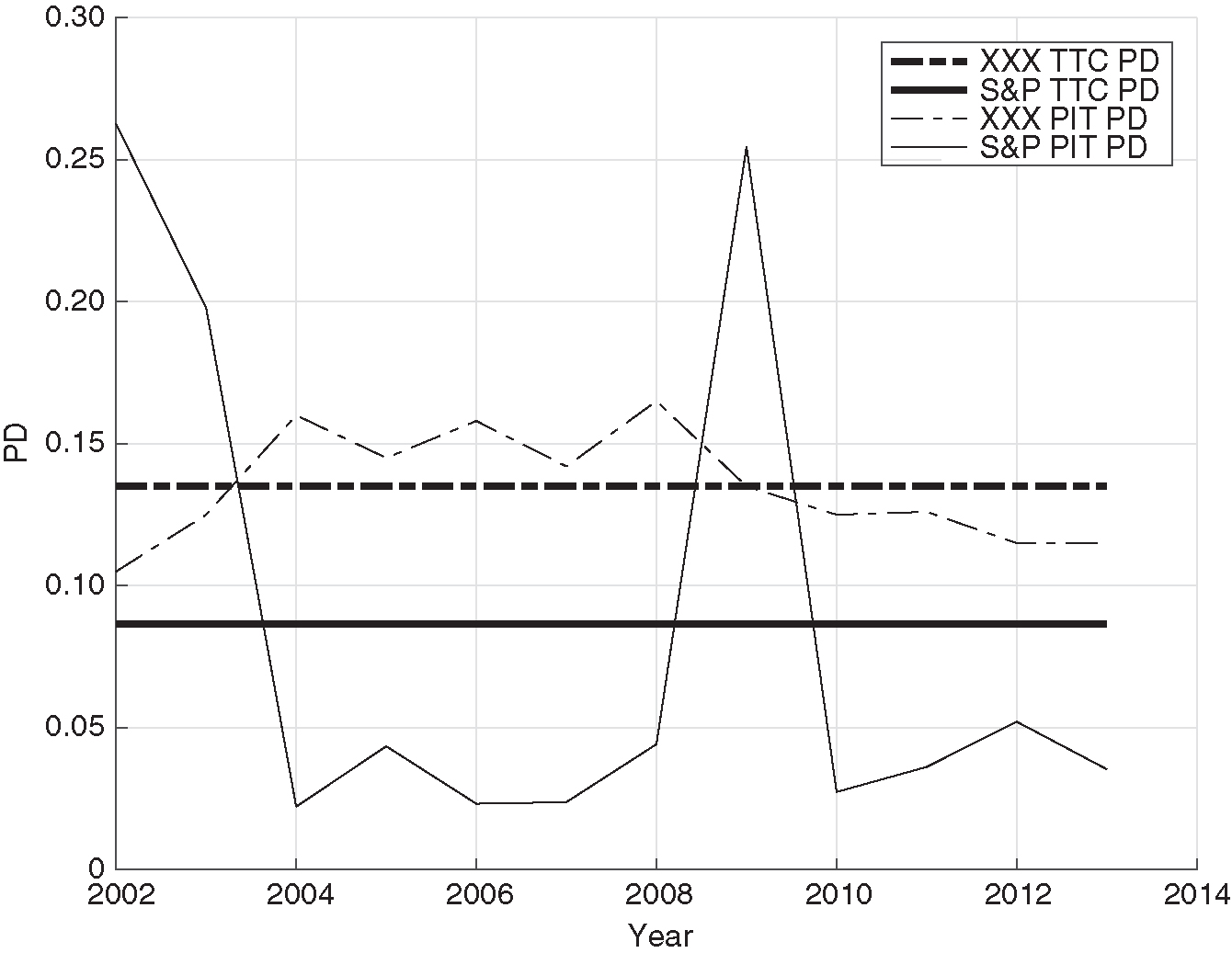

On probability of default and its relation to observed default frequency and a common factor - Journal of Credit Risk

risk - Quarterly Survival rate given there is a Quarterly Probability of Default - Quantitative Finance Stack Exchange

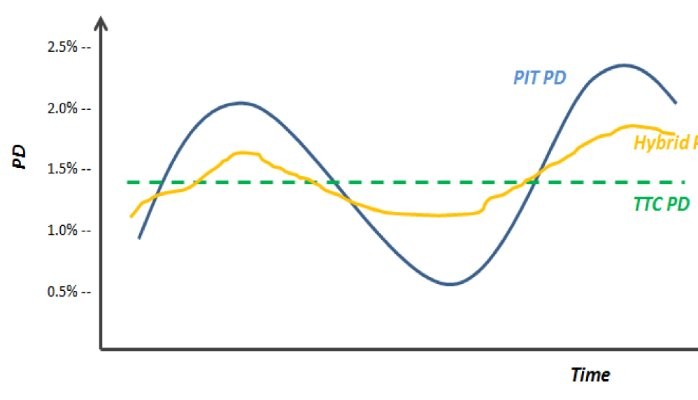

On the mathematical modeling of point-in-time and through-the-cycle probability of default estimation/ validation - Journal of Risk Model Validation